Kenya seeks a World Bank loan to pay off its Eurobond debt

Kenya wants to utilize a portion of the $1 billion loan proceeds from the World Bank to pay off the $500 million remaining on the first 10-year bond, which matures on June 24. This is in the midst of dwindling foreign exchange reserves, declining domestic income collections, and rising expenses, such as debt service costs.

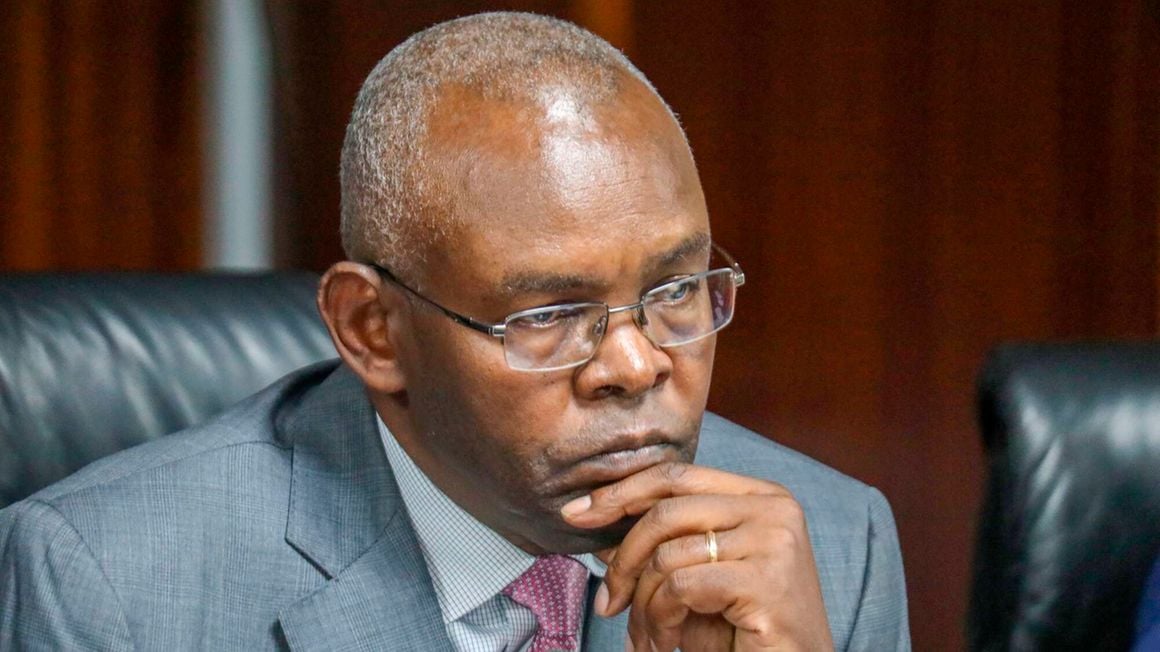

Governor Kamau Thugge of the Central Bank of Kenya (CBK) informed The EastAfrican that the $500 million final installment of the $2 billion bond issued in 2014 will be paid off with the anticipated World Bank payout connected to the Development Policy Operations (DPO).

“That purpose will be served by the World Bank disbursement related to the DPO,” Dr. Thugge declared.

In May 2023, the board of directors of the World Bank Group authorized a $1 billion development plan (DPO) that would assist Kenya’s long-term goal of green and inclusive growth and its near-term goals of fiscal reduction by providing low-cost budget finance and institutional support.

All Categories

Recent Posts

Tags

+13162306000

zoneyetu@yahoo.com