Trump’s Comprehensive Tax and Spending Bill is approved by the US House

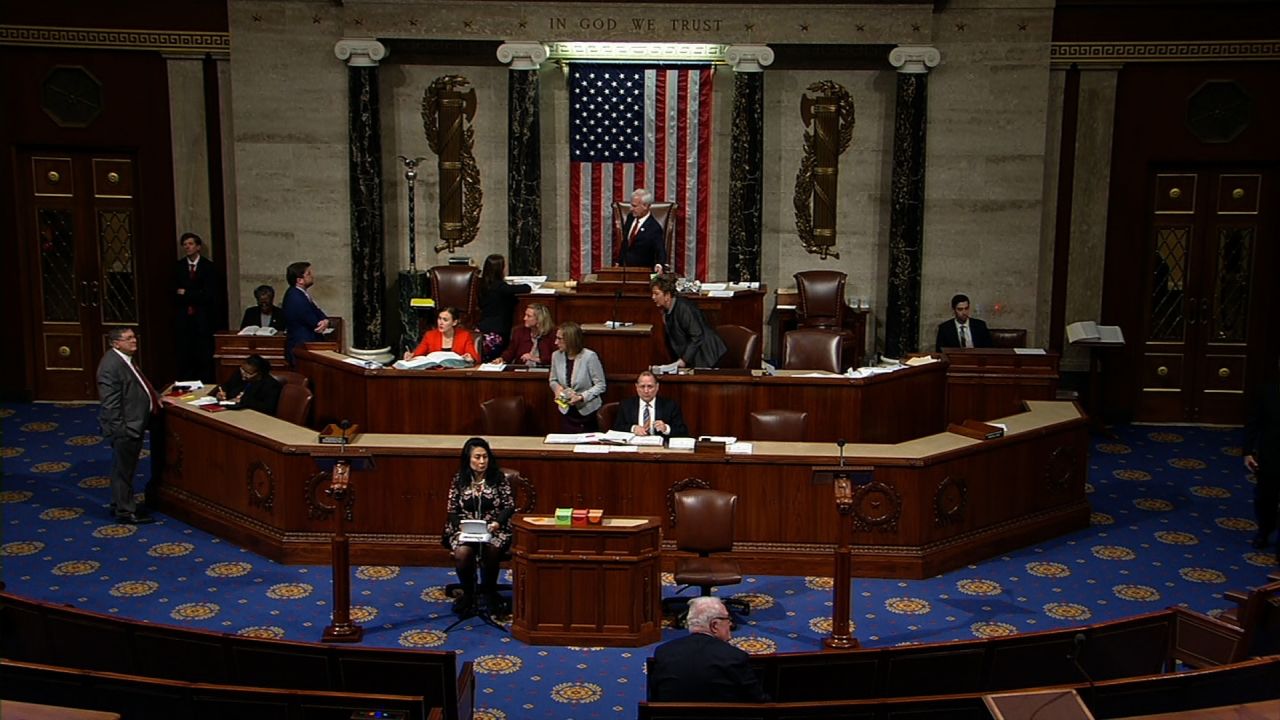

Trump’s comprehensive legislative package, which includes significant tax and budget cuts, was approved by the US House.

A significant step in President Donald Trump’s efforts to change the nation’s fiscal landscape has been taken with the passage of a comprehensive tax and spending plan by the US House of Representatives.

After passing by a narrow vote of 215 to 214, the Act will now go to the Senate for additional review. A few Republican senators have already indicated that they want to try to amend some of the bill’s most important clauses.

The proposed proposal, which Trump has called a “big, beautiful bill,” intends to remove federal taxes on tipped money, extend tax cuts that were implemented during his first term in office, and greatly increase funding for border security and the military.

House Speaker Mike Johnson praised the bill’s ability to implement long-lasting reform to the country’s tax and spending goals, calling it “once-in-a-generation legislation.”

“This is an audacious move that demonstrates our dedication to American workers, families, and national security,” he stated.

Democrats, however, have strongly opposed the bill, claiming that it would increase costs for middle- and lower-class households while disproportionately benefiting the rich.

The Congressional Budget Office (CBO) forecasts that the plan could increase the US national debt by about $2.3 trillion (£1.7 trillion) over the course of the next ten years.

The future of the law is still up in the air, despite the excitement surrounding its passing in the House. The proposal still has a long way to go before becoming law, as the Senate is anticipated to discuss its provisions and possibly request changes.

All Categories

Recent Posts

Tags

+13162306000

zoneyetu@yahoo.com