New Biden Administration Rule Prevents Unpaid Medical Bills from Appearing on Credit Reports

The Biden administration announced a substantial change on Tuesday: credit reports will no longer include unpaid medical expenses.

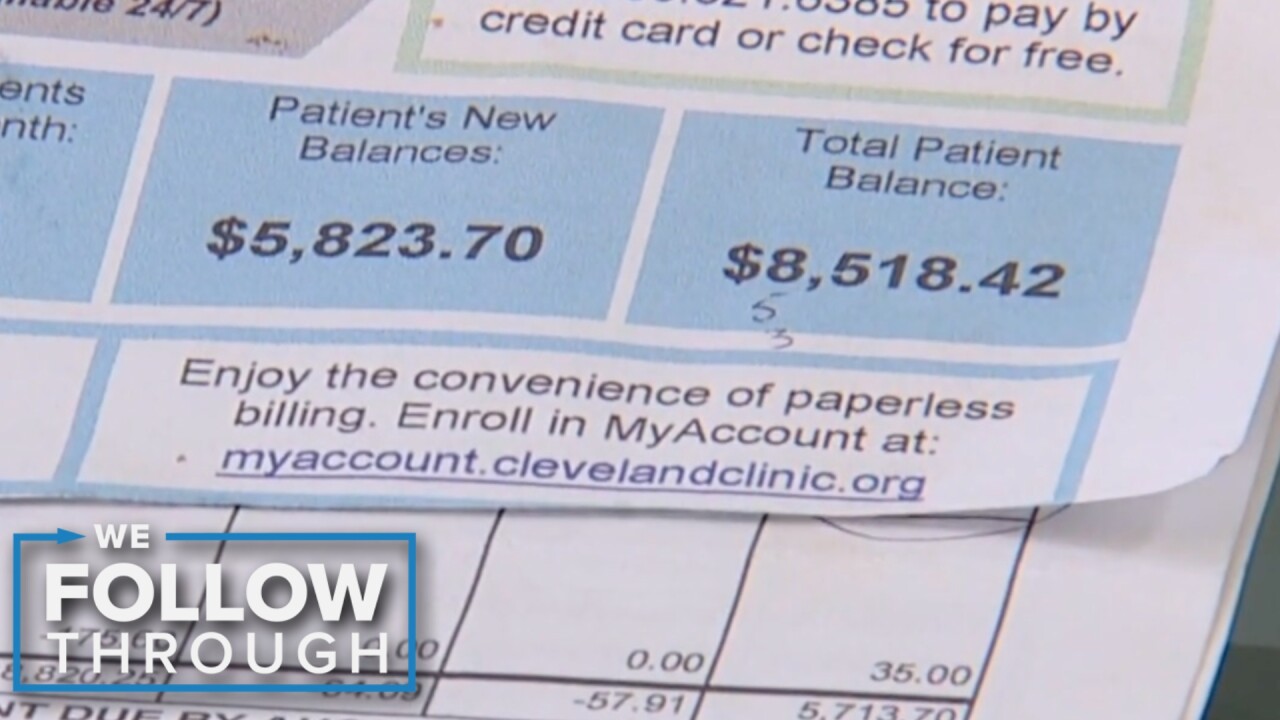

The Consumer Financial Protection Bureau (CFPB) has implemented a new rule that seeks to eliminate $49 billion in medical debt from the credit reports of more than 15 million Americans. This will facilitate enhanced access to financial opportunities and loans.

The Consumer Financial Protection Bureau (CFPB) observed that the rule would prevent lenders from considering delinquent medical debt when making decisions regarding mortgages, auto loans, or small business loans. This modification is anticipated to increase credit scores by an average of 20 points, which could lead to an additional 22,000 mortgage approvals annually.

Vice President Kamala Harris praised the rule’s transformative potential, describing it as “life-changing” for millions of families. Harris stated in a statement that no individual should be denied economic opportunity as a result of illness or a medical emergency.

Harris also emphasized the accomplishments of states and local governments that have utilized funds from a 2021 pandemic-era aid package to eliminate over $1 billion in medical debt, thereby benefiting over 700,000 Americans, in addition to the credit report adjustments.

In autumn 2023, the Consumer Financial Protection Bureau (CFPB) initially proposed the rule, emphasizing that medical debt is an unreliable indicator of an individual’s capacity to repay loans. Last year, the three main credit reporting agencies—Experian, Equifax, and TransUnion—had already implemented measures to eliminate medical collection debts under $500 from their reports. The new rule builds upon those endeavors by concentrating on the residual unpaid medical expenses that are listed on credit reports.

All Categories

Recent Posts

Tags

+13162306000

zoneyetu@yahoo.com