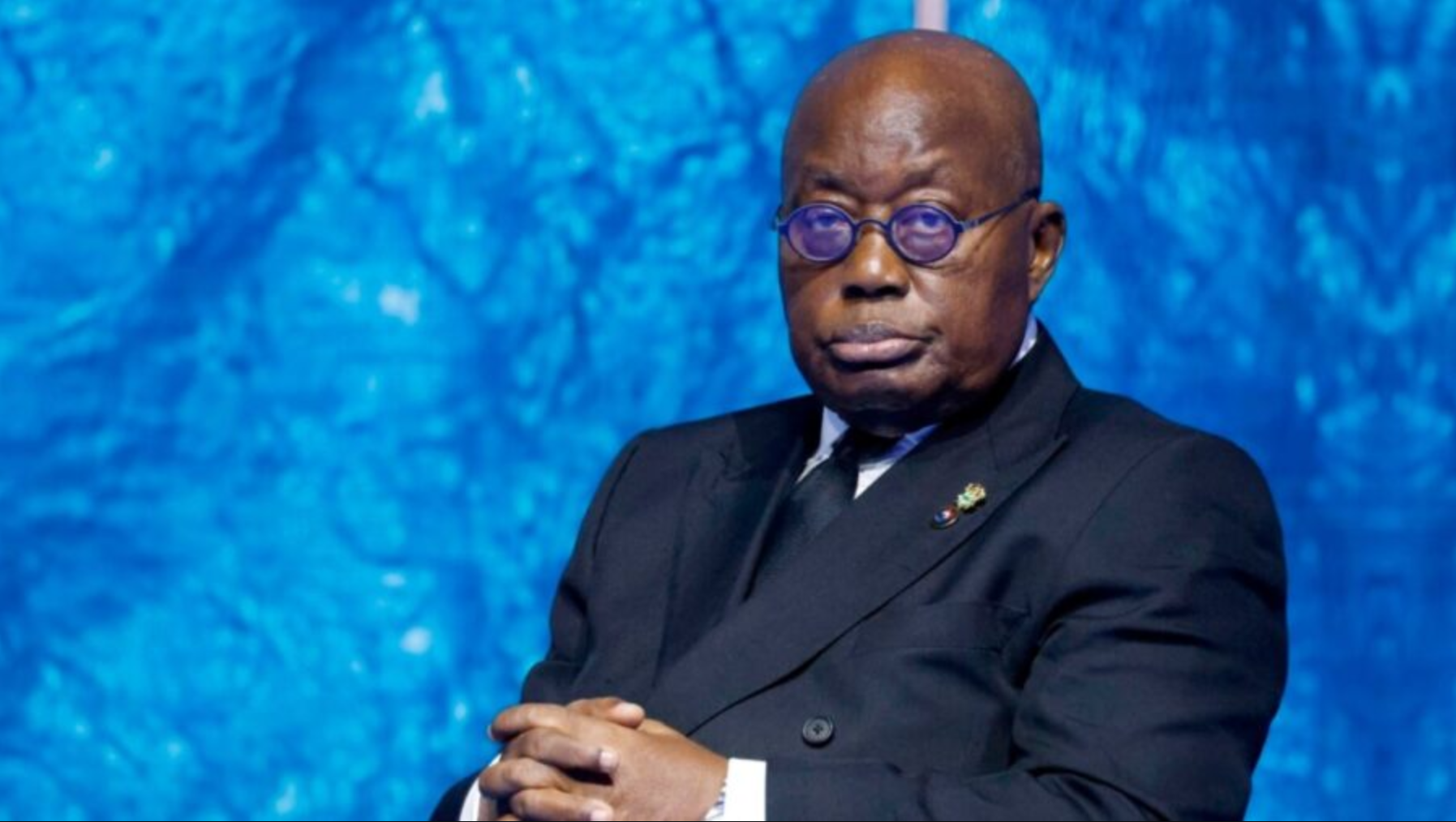

Ghana makes a restructuring bid on its bonds worth $13 billion

More than two months after reaching a preliminary restructuring agreement with two bondholder groups, Ghana asked holders of its approximately $13 billion worth of international bonds to exchange their holdings for new instruments on Thursday.

The government stated in its “exchange offer and consent solicitation” released in a regulatory statement on the London Stock Exchange that bondholders have until September 30 to accept the offer, but those who agree to do so before an early deadline on September 20 will be eligible for a 1% consent fee.

The manufacturer of cocoa and gold from West Africa went into default on the majority of its $30 billion international debt in 2022 because to the COVID-19 outbreak, the conflict in Ukraine, and rising interest rates worldwide.

Under the G20 Common Framework, Zambia and Chad have also reached agreements, and it is restructuring its debt. Ethiopia is anticipated to follow, yet many have criticized the setup for being laborious and slow.

The manufacturer of cocoa and gold from West Africa went into default on the majority of its $30 billion international debt in 2022 because to the COVID-19 outbreak, the conflict in Ukraine, and rising interest rates worldwide.

Under the G20 Common Framework, Zambia and Chad have also reached agreements, and it is restructuring its debt. Ethiopia is anticipated to follow, yet many have criticized the setup for being laborious and slow.

There will be a 37% main write-down associated with that option.

The second is a $1.6 billion par bond option with three instruments, the principal of which will mature in 2037 with no haircut other than a write-down of past-due interest and pay a 1.5% yield. The deal is valid for 21 days.

Under the terms of the agreement, bondholders in Ghana will forfeit around $4.7 billion of their loans, resulting in approximately $4.4 billion in cash flow relief until 2026, when the country’s current International Monetary Fund program ends.

The declaration on Thursday, according to Godfred Bokpin, a professor of finance and economics at the University of Ghana, was a significant turning point in the nation’s restructuring initiatives.

He stated to Reuters: “With this, investors now have a fair understanding of their losses and they can move on.”

October 9 is when the new bonds will be released, according to a government statement. Guarantee payments for holders of the Ghana 2030 international bond, which is part of the restructuring and was partially guaranteed by the World Bank, would be made on the same day or as soon as practicable after the restructuring.

All Categories

Recent Posts

Tags

+13162306000

zoneyetu@yahoo.com