A study indicates that China’s lending to Africa has increased for the first time in seven years

An independent analysis released on Thursday revealed that Chinese lenders granted $4.61 billion in loans to Africa last year, the first yearly increase since 2016.

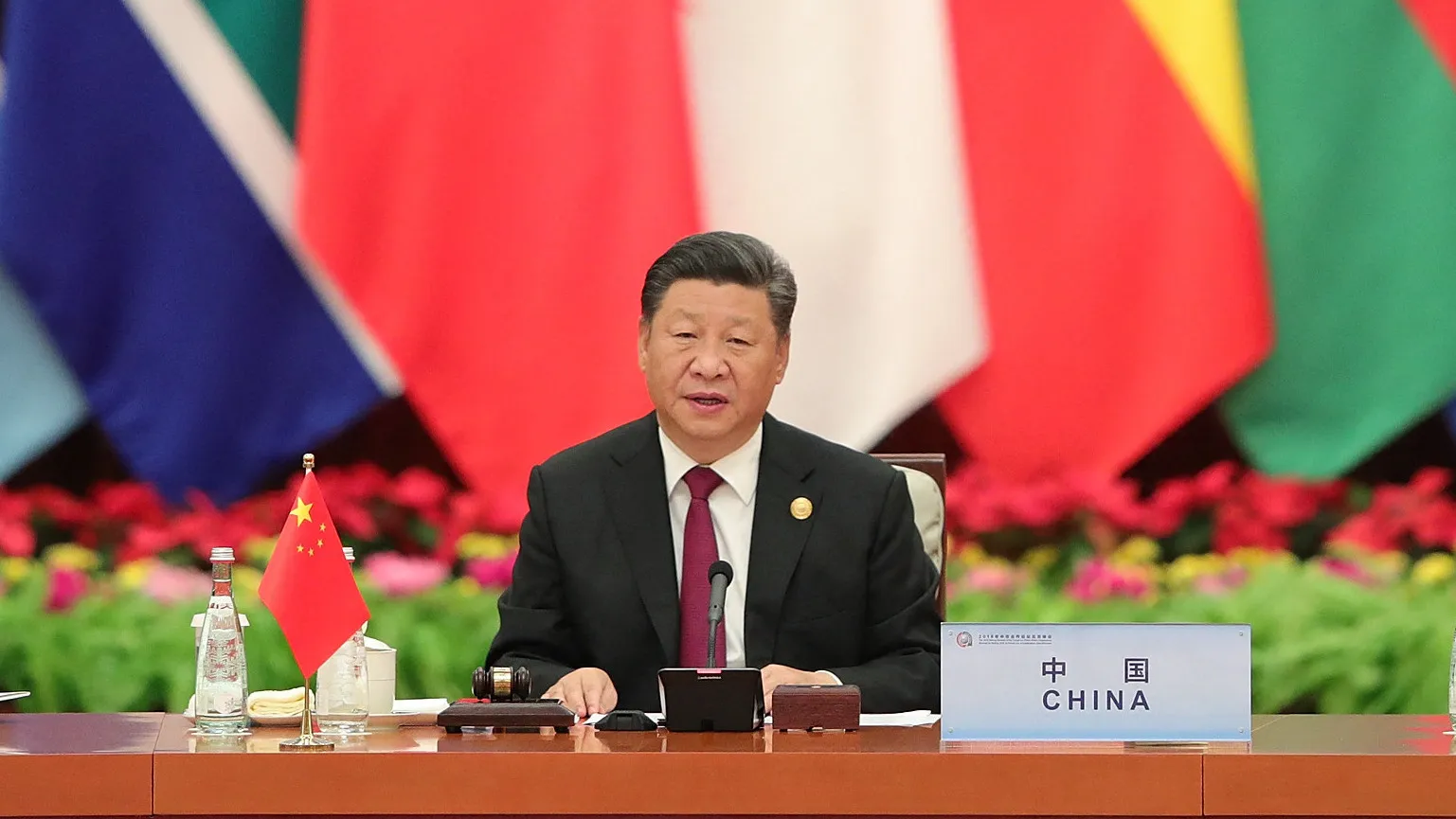

Thanks to President Xi Jinping’s Belt and Road Initiative (BRI), Africa was able to obtain over $10 billion in loans annually from China between 2012 and 2018. However, the lending abruptly stopped in 2020 when the COVID-19 epidemic broke out.

The number from last year, which increased by more than three times from 2022, indicates that China is eager to reduce the hazards connected to heavily indebted countries, according to a study conducted by Boston University’s Global Development Policy Center.

China seems to be searching for a more stable loan level and trying out a fresh approach, according to the university center that oversees the Chinese Loans to Africa Database project.

The latest information is released as Beijing gets ready to welcome African leaders to Beijing for the biannual Forum on China-Africa Cooperation next week.

According to the report, there were 13 loan agreements signed by two African multilateral lenders and eight African nations last year.

The largest items from the previous year were a nearly $1 billion loan from the China Development Bank to Nigeria for the Kaduna to Kano Railway and a comparable size liquidity facility provided to the central bank of Egypt by the lender.

In recent years, China has risen to the top of the list of bilateral lenders for many African countries, including Ethiopia.

According to a Boston University research, it has lent the continent a total of $182.28 billion between 2000 and 2023, with the majority of the funds going to the region’s ICT, transportation, and energy sectors.

In the early years of the Belt and Road Initiative (BRI), Africa played a significant role as China attempted to replicate the historic Silk Road and increase its geopolitical and economic sway by pushing for the building of global infrastructure.

However, the epidemic accelerated China’s decision to cut off financial support in 2019, leaving a number of unfinished projects throughout the area, including a contemporary railway that was intended to connect Kenya with its neighbors.

Growing debt loads among African economies and internal pressures in China were the main causes of the loan cut. Since 2021, Zambia, Ghana, and Ethiopia have undergone extensive debt restructuring.

Beijing’s new approach is shown by the fact that more than half of the loans made last year—$2.59 billion—went to national and regional lenders, according to a Boston University research.

“Chinese lenders’ focus on African financial institutions most likely represent a risk mitigation strategy that avoids exposure to African countries’ debt challenges,” said the report.

According to the report, three solar and hydroelectric energy projects accounted for about a tenth of 2023 loans, showing China’s intention to shift its financial focus from coal-fired power plants to renewable energy.

However, the study demonstrated that since Chinese banks also provided loans to struggling economies such as Nigeria and Angola, the apparent patterns in the previous year’s data did not provide a clear direction of China’s financial engagement with the continent.

The Global Development Policy Centre stated, “It remains to be seen whether China’s partnerships in Africa will retain their quality.”